Homeownership Overview

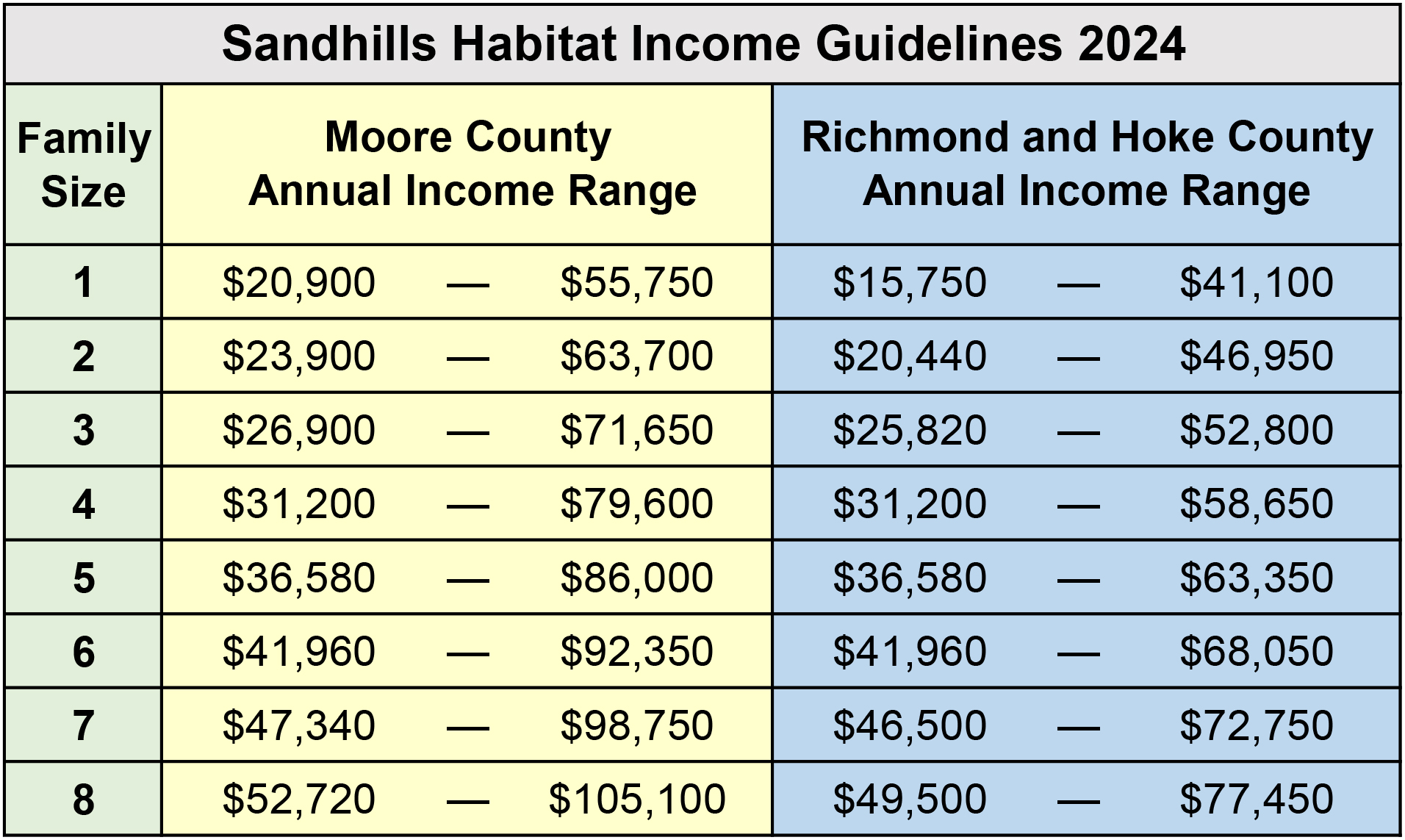

Sandhills Habitat works with people making between 30% and 80% of the Area Median Income to build and purchase homes with affordable mortgages. These homebuyers come from many different walks of life but share the dream of owning a home. We partner with homebuyers based on financial qualifications and do not discriminate based on an applicant's race, color, sex, sexual orientation, national origin, age, religion, or handicap. We understand that the journey to owning a home can be overwhelming. That's why we're here to guide you through the process - from learning about personal finances, mortgages, maintenance, and much more. Our path to homeownership is an in-depth process that requires hard work, time, and dedication. But don't worry; we'll be with you every step of the way to ensure that you're fully prepared for the responsibilities of homeownership. Let's work together to make your dream of owning a home a reality!

Watch this video to learn more.

Qualifications

To be considered for a Habitat home, families must demonstrate a need for affordable housing, be willing to partner with Habitat and be able to repay an affordable mortgage. In addition, they must meet the following requirements:

- US citizen or legal resident

- Live or work in Moore, Richmond, or Hoke County for over 12 months.

- A satisfactory credit history with no recent bankruptcy filings, unpaid collections, or judgments.

- A debt-to-income ratio of 10% or less

- Ability to save $2000 for closing costs

- Proof of their ability to live financially independent for 18 months before applying

- Must not be a registered sex offender and will be subject to a criminal background check.

An affordable mortgage does not exceed 30% of household income, including property taxes, insurance, and principal.

Eligibility Requirements

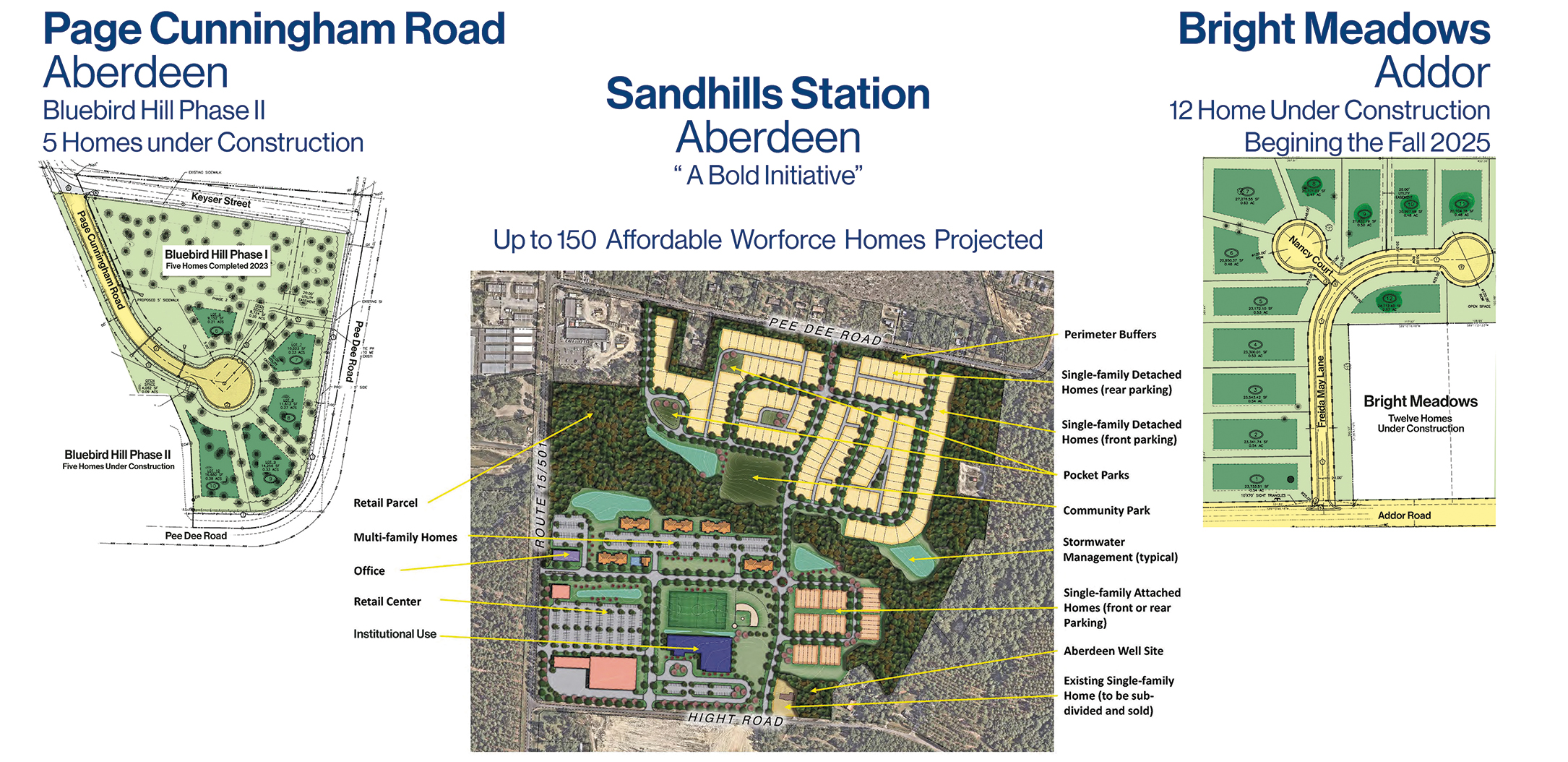

Future Communities

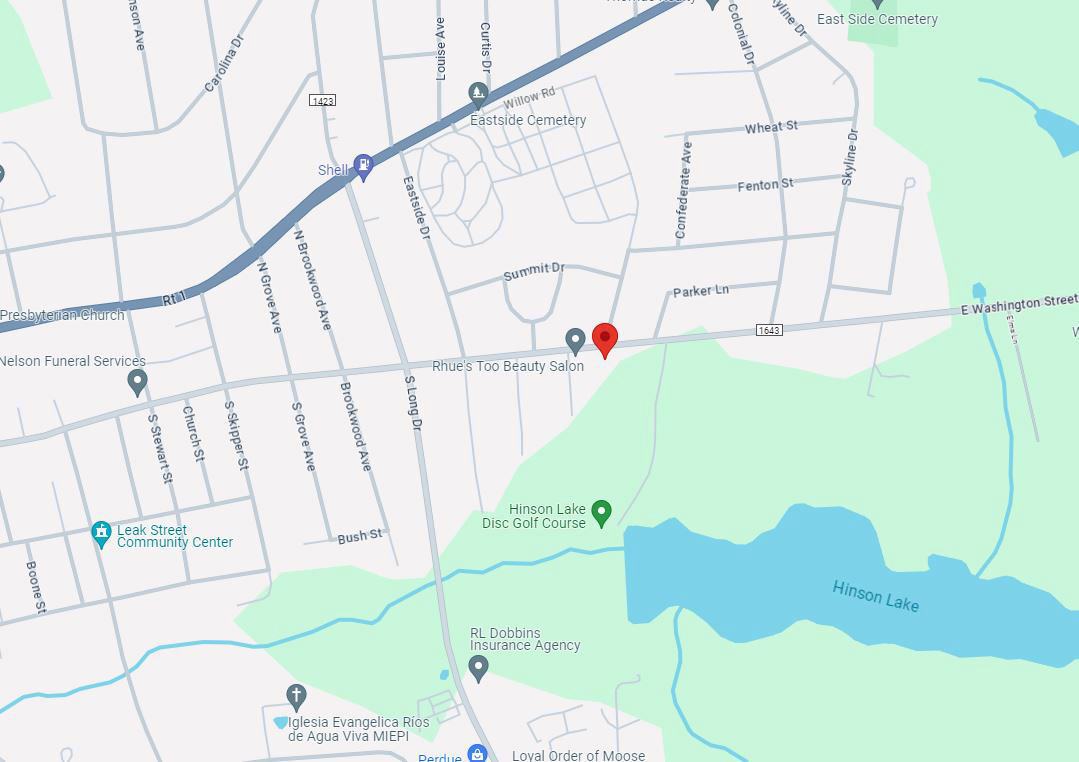

Homes Available in Rockingham

1710 and 1720 East Washington Street

This single story bungalow style house of 1128 square feet features a large open living and dining area with optional vaulted ceiling and a private master bedroom suite. The plan includes a total of three bedrooms, two full bathrooms, a laundry area, and U-shaped kitchen with a breakfast bar passthrough that opens to the dining room.